ML Perspective Predicts with Over 80%¹ Accuracy 1.800 Weekly Quotes between 21/12/2021-25/04/2022

- Alejandro Romero

- 10 Ağu 2022

- 1 dakikada okunur

*Remember that when an interactice chart is cited on the post, by clicking on it the source code will be shown, In order to visualize it on the right way, download the file as html and open it with your browser.*

Sample: 100 most traded ETF in USA.

Data: Weekly quotes.

Dates: 21/10/2021 - 25/04/2022.

Quantity: 19 weekly quotes per security (1.800 andlesticks in total).

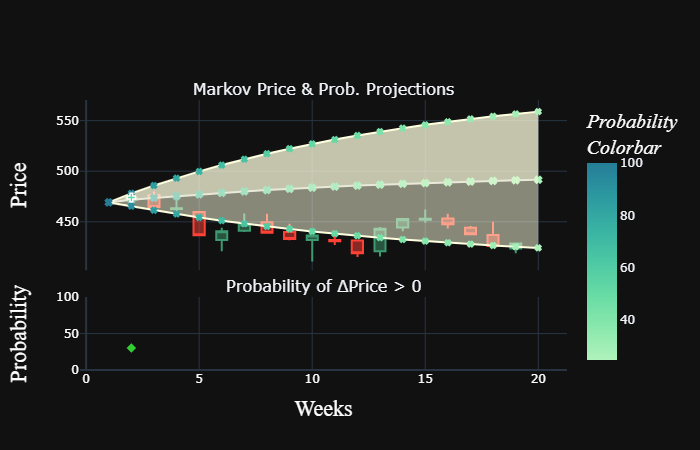

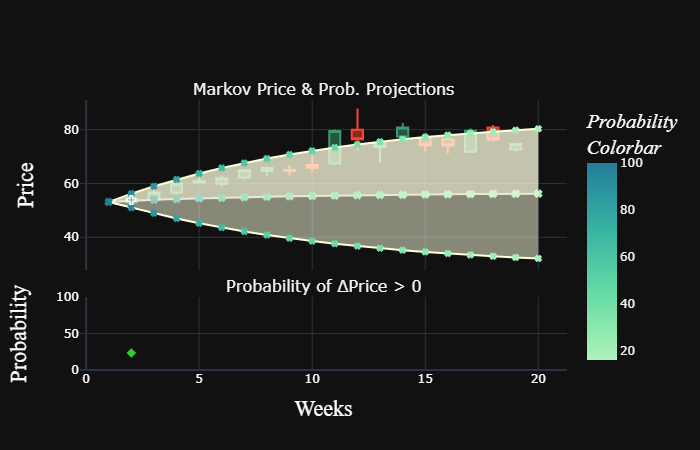

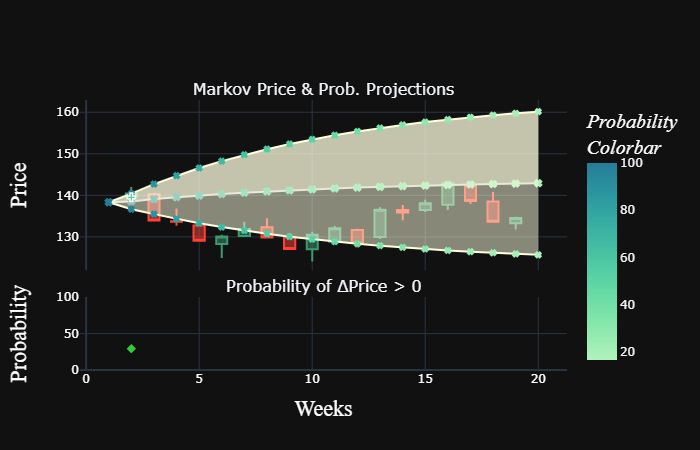

Method: Markov General Model + Pattern Search to Decimals

Breakthroughs:

Not a regression problem anymore but categorical.

Not focus on quotes but on quote changes (delta price).

Approach changed, instead of identifying patterns through time-series' surveilance (technical analysis) time-series freely oscilate over price change patterns.

No fundamental analysis (all information is reflected on the price change assumption).

Not multiple variables (inflation, benchmarks, etc.) but one (delta price).

Outcomes:

Accuracy at 80,30% while precision at 86,97%. Confusion matrix (values in %):

| PN² | PP | |

AN | 1,18 | 11,85 | 13,03 |

AP | 7,85 | 79,12 | 86,97 |

| 9,03 | 90,97 | |

2. Works over sectors and markets (14 examples out of 100):

iShares Global Clean Energy

iShares 7-10 Years Treasury Bond

VanEck Junior Gold Miners

iShares MSCI Brazil

iShares Russell 2000

SPDR Bloomberg High Yield Bond

SPDR S&P Regional Banking

KraneShares CSI China Internet

SPDR S&P 500

United States Oil Fund

Vanguard Emerging Markets Stock Index Fund

Consumer Staples Select Sector SPDR Fund

Health Care Select Sector SPDR Fund

Financial Select Sector SPDR Fund

¹Average of the sample yields to this valıue, individual values oscilate between 71% and 97%.

²PN: Predicted negative means the probability, the model estimated, of the actual price not ending up within the predicted range.

All these calculations are based on probabilities, which can fail sometimes; however, the developed algorithm to reach those numbers has been thought to reduce such failures to their lowest level.

Commentaires